We are excited to announce the promotion of Kevin Tucker to Director of IT. Kevin…

Non-Standard ABS – It Pays to be Complex

By Marc Tourville, Managing Director

The asset-backed security (ABS) market used to mean auto loans, credit cards, and student loans. Over the last 12 years, the ABS market evolved considerably to include smaller and more diverse sectors within commercial assets and consumer loans. The deeper ABS market that exists today creates an opportunity for managers with the resources, data, and experience to extract an attractive “complexity premium.”

Key takeaways:

- There is a 50 to 200 basis point yield advantage compared to traditional ABS

- The underlying collateral is diverse across multiple segments of the economy

- Cash-flow profiles are not homogenous and require more effort to underwrite

- Typical deal size ranges from $200M – $1B

- Approximately 75% of issues are not index eligible due to the smaller deal size

Asset class attributes

Non-standard ABS, sometimes called esoteric or private-label ABS, is the broad term used to describe asset-backed securities beyond the traditional credit card, auto loan, and student debt ABS. Underlying collateral can range from business essential assets (shipping containers, railcars, aircraft, cell towers, and small equipment) to small business loans, personal loans, franchise royalties, and timeshare loans. The overall ABS market is roughly $1 trillion and growing, and greater than $3 trillion if you include Non-agency RMBS, CMBS, and CLOs.

The reward for navigating in this niche and complex market is attractive concessions in spread, which can range from 50 to 200 bps over comparable traditional ABS and some corporates. Even with 50-60% of these securities being A-rated, yields can be at or above BBB corporates with a shorter duration.

Credit support is strong given the higher underwriting requirements for the unique collateral, sometimes reaching 40-50% in total credit enhancement. ABS performed well in the Global Financial Crisis (GFC) and again in 2020 as the pandemic took hold. Importantly, Non-standard ABS can become significantly mispriced during market dislocations when algorithmic or matrix pricing is used instead of market transactions.

ABS are amortizing bonds that generate strong cash flows, often returning 2.0% – 2.5% to investors monthly in interest, paydowns, and maturities. This can create reinvestment risk, but also opportunity in a rising rate environment. This also means that ABS bonds de-lever over time which creates upwards rating pressure. The market tends to have a 5:1 ratio of upgrades to downgrades.

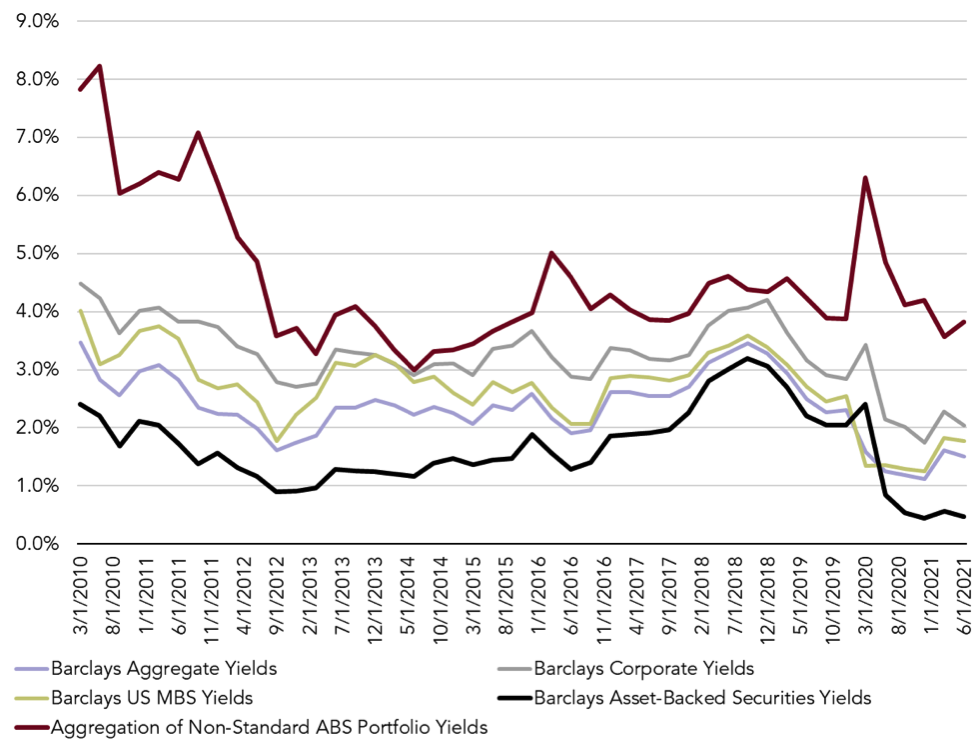

Absence of the FOMC

The Federal Reserve’s response to the pandemic included significant asset purchases across debt markets, creating significant downward pressure on yields. Being too small of a market for the Federal Reserve’s programs, the Non-standard ABS market experienced meaningfully lower yield compression. The drivers of yield advantage in this sector, which have been stable since 2009, again held up at similar levels while other sectors fell to record low yields.

Manager Research Focus:

- Managers must have robust internal cash-flow models to analyze the underlying securities, support levels, and stress-test risk scenarios.

- Is there an observable long-term track record in either dedicated Non-standard ABS mandates or structured sector specialist sleeves within a multi-sector platform?

- Is there sufficient scale to gain access to senior management at the issuers?

- Requires tenure and experience analyzing an issuer’s prior deals/issuance.

Implementation considerations

Most portfolios need to be built through new issuance in the primary market. Secondary market liquidity is similar to the corporate market, but a large portion of lenders hold securities to maturity given the attractive yield/risk profile. Building a diversified portfolio of 30 – 60 holdings can take four to six months. Allowing the manager to call capital as opportunities arise helps with implementation.

The majority of issues will be 144a securities, which is typically a constrained exposure in insurance guidelines. Many issues only have one rating, often by Egan Jones or Kroll, which some insurers may need to identify as permitted NRSROs within their guidelines.

Investors should be mindful of several key constraints when creating a mandate:

- Limits on individual issuers, BBB-rated securities, Non-agency RMBS, CMBS, CLOs

- Whether to permit below investment grade deals

- Whether to permit Reg. D private placements

The out-of-benchmark nature of this asset class makes it…. hard to benchmark. Most managers will utilize the Bloomberg U.S. ABS index, ICE U.S. ABS and CMBS, or the J.P. Morgan Other ABS Index. Investors should not expect a portfolio of Non-standard ABS to track closely to any of these indices. Alternative or supplemental forms of benchmarking may help to better assess the asset class.

Conclusion: Enhanced yield without sacrificing quality or liquidity

For institutional investors seeking higher yields but looking for alternatives to less liquid private debt, Non-standard ABS might be just the right diversifying exposure. Either as a stand-alone mandate or adding to an existing core bond mandate, Non-standard ABS can be both a yield enhancer and diversifier with strong cash flow.

Interested in learning more? Contact Cardinal Investment Advisors here.

——

About Marc Tourville, Managing Director

About Marc Tourville, Managing Director

Marc joined Cardinal in 2004. Marc is the lead consultant on several clients and is also responsible for insurance-specific research and fixed income manager research.