By Sean M. Kane, CFA Performance-based fees have existed for many years in both the…

Nancy Reagan and the Case for Commodities

By Matt Padberg, Managing Director

Commodities did fantastically well over the past few years, earning 40% in 2021 and 26% in 2022. After such strong performance investors may be asking if they should have an allocation to this asset class.

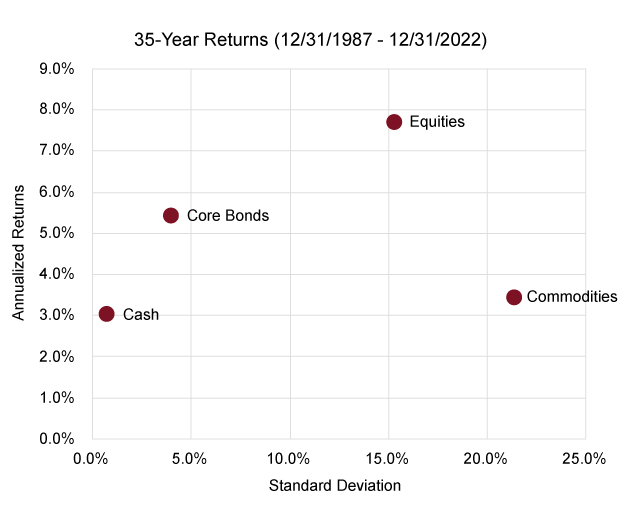

Cardinal prefers to take a longer-term view. Over the past 35 years, commodities produced cash-like returns with equity-like volatility:

Exhibit 1

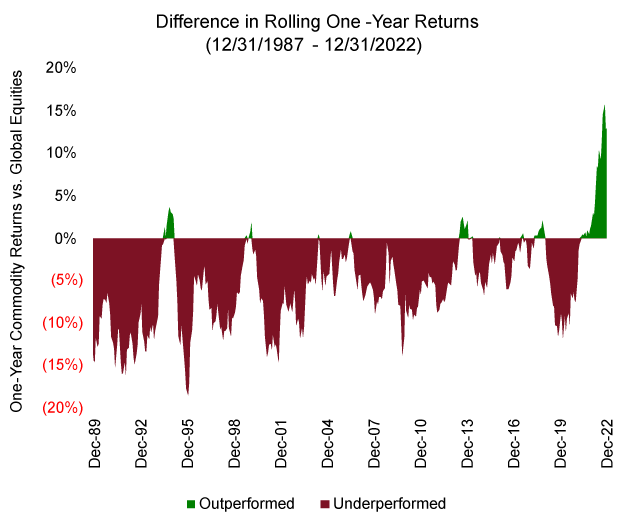

While this analysis is based on data availability, 35 years is a strange time period that might seem like data mining. To allay this concern, we compared rolling one-year commodity returns to rolling one-year global equity returns. We chose equities as the basis of comparison because of the similar volatilities of these two asset classes.

The past two years are clearly outliers:

Exhibit 2

We think Nancy Reagan’s advice about (a rather different type of) commodities is sound: “Just say no.”

Note on indices:

- Cash: ICE Bank of America 90-Day Treasury Bills

- Bonds: Bloomberg Barclays US Aggregate

- Global Equities: MSCI ACWI

- Commodities: S&P GSCI Commodity

Cardinal Investment Advisors is a 100% employee-owned, independent firm focused solely on institutional investment consulting. After 20 years, this remains their sole line of business. Cardinal’s mission is to serve institutional investors with unique liability streams by developing, implementing and sustaining customized investment strategies that best enable their clients to fulfill their investment and operating goals in an independent and conflict-free manner.

Interested in learning more? Contact Cardinal Investment Advisors here.