We are excited to announce the promotion of Kevin Tucker to Director of IT. Kevin…

Is Your Portfolio Inflation Proof?

By Sean M. Kane

A recovering economy, rising treasury yields, and continued expansionary government policy including trillions of dollars of future spending have stoked concerns about a significant increase in inflation.

“We are at a secular turning point for both inflation and interest rates,” Bank of America said in a market note earlier this year.

Many institutional investors logically conclude they should assess how “inflation-proof” their portfolios are. Cardinal Investment Advisors Managing Director, Sean M. Kane, shares that if portfolios consist of assets that have demonstrated highly positive correlations to the Consumer Price Index (CPI), it follows that they should be well hedged against the negative impacts of inflation.

Expected vs. unexpected inflation

Let’s start by establishing the difference between expected and unexpected inflation—since it is protection against the latter that investors really want.

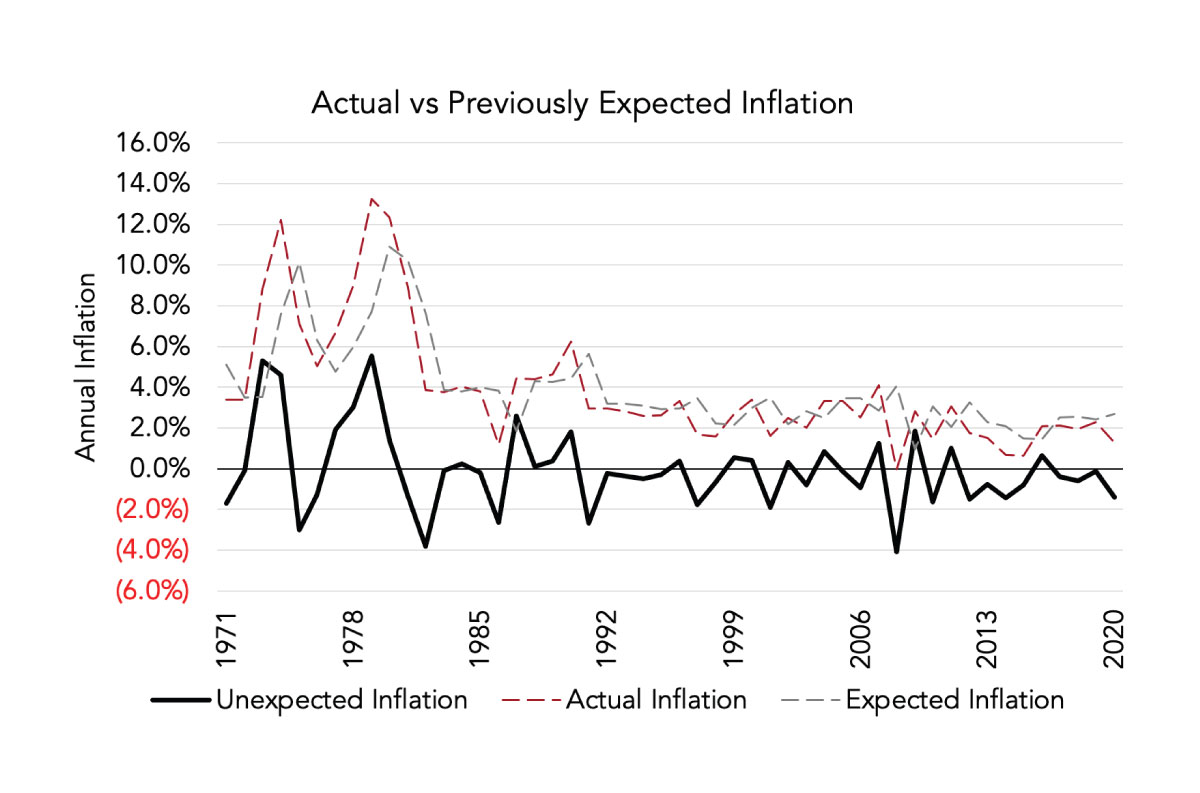

Using the CPI-All Urban index as our proxy for general levels of inflation, historic time series analysis shows a high degree of serial, or auto, correlation from period to period. Another way to state this is to say that inflation is “sticky.” We don’t see inflation move erratically year-over-year and we rarely ever see actual deflation (negative rate of growth in price levels).

Expected Inflation = [Previous Period Inflation x autocorrelation coefficient, or “stickiness factor”] + [Long-term equilibrium of Inflation x (1 – autocorrelation coefficient)]

Historic average inflation can be used as a reasonable estimate of the long-term equilibrium.

Using government-issued CPI data back to the 1920s, we can produce a rolling estimate of what expected inflation would have been for each year historically by calculating the serial correlation and long-term average inflation level each year. We can then observe the difference between what occurs in a given year compared to the forecast to calculate unexpected inflation.

Unexpected Inflation = Actual Inflation – Expected Inflation

Exhibit 1 displays actual vs. previously expected inflation using the above methodology. Note how the expected inflation is strongly influenced by the prior period and how the unexpected inflation vacillates around 0, indicating this forecasting approach is unbiased.

What are good inflation-hedge asset classes?

Now that we have a way to discern unexpected from actual inflation, we can better assess the efficacy of asset classes in hedging against inflation that is not initially priced into assets.

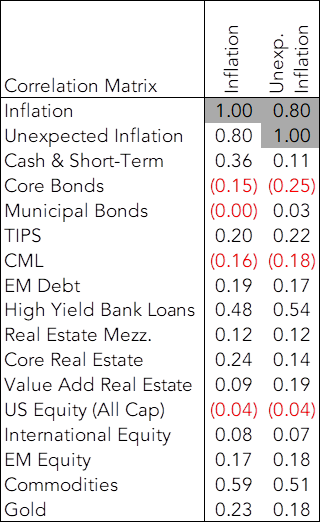

Exhibit 2 presents a correlation table of asset relationships with both actual and unexpected inflation.

As expected, core bonds have a decidedly negative relationship to inflation given the erosion of the purchasing power of the fixed stream of income. They are not a good hedge.

Note that most assets produce lower correlations to the more insidious, unexpected inflation than they do to actual inflation. One exception is TIPS. Mechanically, TIPS generate their inflation protection by paying a coupon based off of a nominal principal amount invested, which increases based on the amount of observed CPI. Given this occurs after the fact, it protects slightly better against unexpected inflation.

Floating rate fixed income assets, such as high yield bank loans, not only price off a very reactive short-term rate like LIBOR but also adjust quarterly and include a mechanism to convey actual and unexpected inflation efficiently.

Stability of inflation protection – Is it there when you need it?

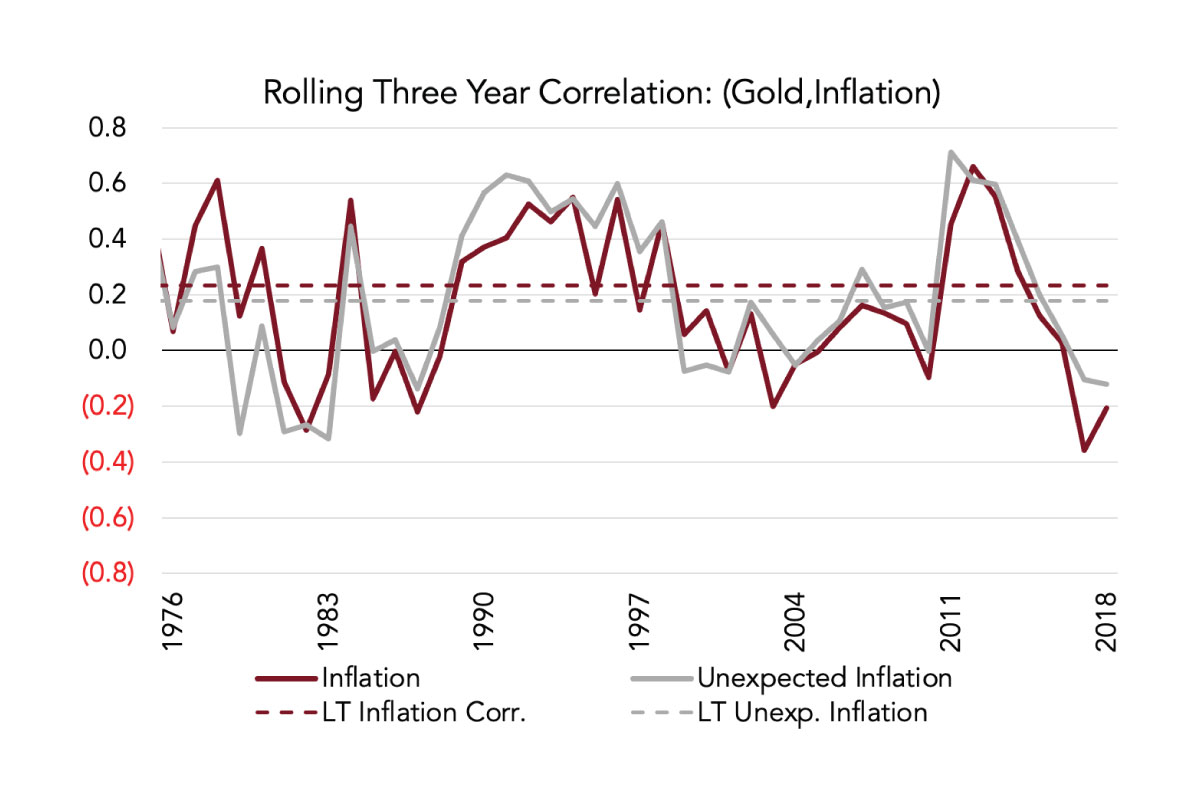

Commodities like gold offer an interesting view on the stability of inflation protection. While offering high “typical” correlations to both forms of inflation, Exhibit 3 shows that when observed over three-year rolling periods (solid lines), the inflation hedge efficacy of gold as an asset class is fleeting or non-existent.

Key takeaways

Investors should consider an asset’s stability of protection against both actual and unexpected inflation when evaluating their portfolio. Degrees of inflation hedging properties vary widely across assets and within an asset over time. Institutional investors looking to protect their portfolios from inflation should initially evaluate their composite portfolio’s correlation history versus expected and unexpected inflation. Then, if a greater inflation-hedge is desired, new mandates utilizing assets with higher CPI correlations or a blended real assets strategy can be employed.

Sean M. Kane, CFA, Managing Director

Sean is a founding partner of Cardinal. He manages the pension team at the firm and leads the capital markets research function.

Cardinal Investment Advisors

Cardinal Investment Advisors is a 100% employee-owned, independent firm focused solely on institutional investment consulting. After 19 years, this remains their sole line of business. Cardinal’s mission is to serve institutional investors with unique liability streams by developing, implementing and sustaining customized investment strategies that best enable their clients to fulfill their investment and operating goals in an independent and conflict-free manner.

Interested in learning more? Contact Cardinal Investment Advisors here.

.