We are excited to announce the promotion of Hannah Atkinson to Director of Performance. Since…

Interest Rates and Equity Style Returns through the Pandemic

By Matt Padberg

COVID-era equity returns have been dramatic. In the first quarter of 2020, when public health measures caused economic growth to slow significantly, US Large Cap Growth lost -14% while Value lost -27%. Since then, equity markets rebounded sharply with Growth up +70% and Value up +62%. Much of the dispersion between Growth and Value can be tied to interest rate movements.

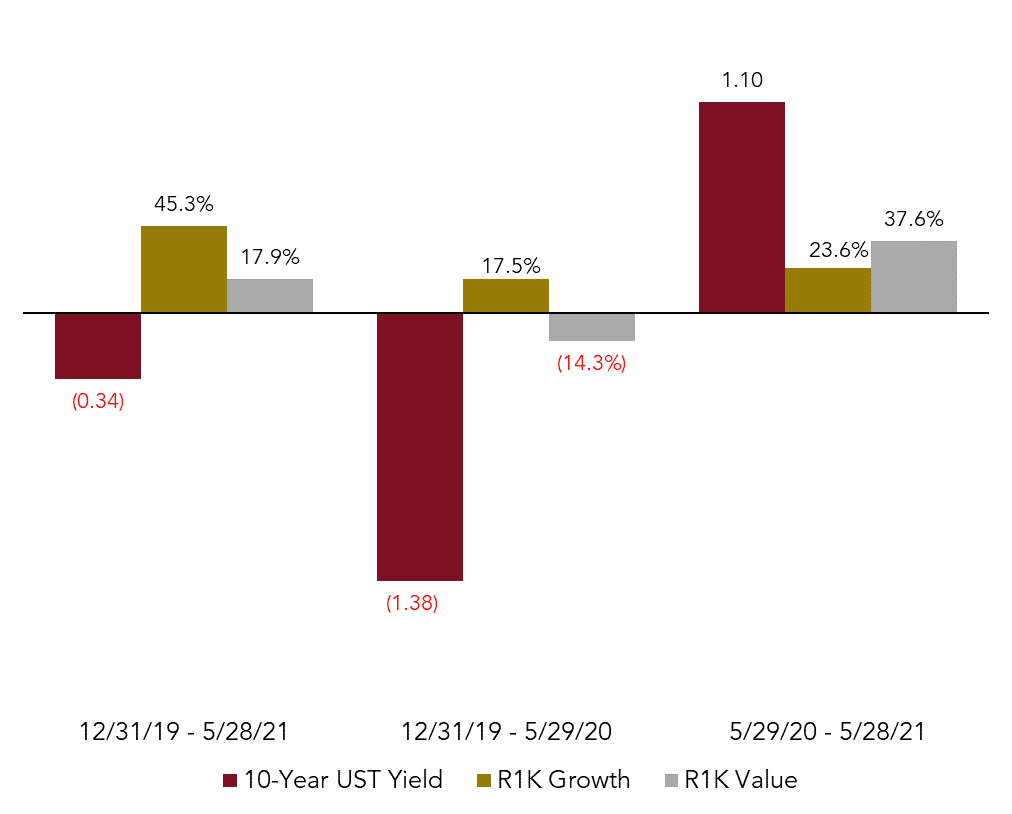

Using monthly data, 10-year US Treasury yields started at 1.92% on December 31, 2019, bottomed at 0.54% on May 29, 2020, and subsequently increased to 1.58% as of May 28, 2021. Growth far outperformed Value over the entire period. For the first five months when rates dropped dramatically, Growth outperformed Value by 31.8%. This partially reverted in the second period. As rates rose to 1.58%, Value outperformed Growth by 14%.

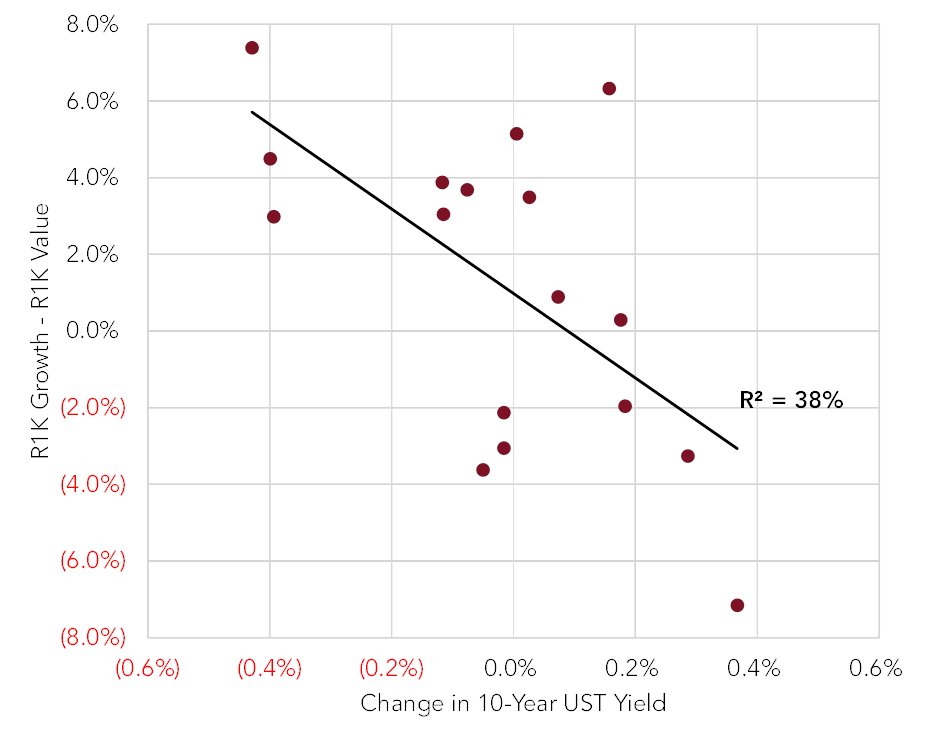

Monthly data indicates a reasonably significant relationship between changes in interest rates and the dispersion between Growth and Value returns.

Over the 16-month period beginning January 2020, Growth outperformed Value when rates declined and vice versa. Of course, this is not as simple as just interest rates. The partially shut economy favored tech stocks and growth companies, while elevated savings rates and re-opening economies seem to favor both higher interest rates and traditional, in-person sectors of the economy.

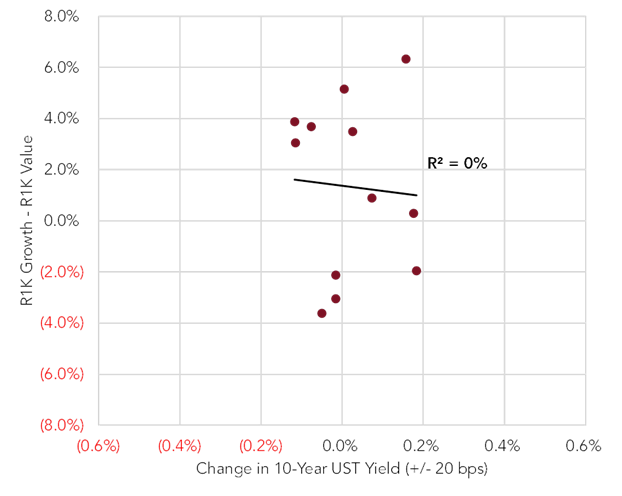

Interestingly, when monthly interest rate movements are muted, say within +/- 20 basis points, these movements had no consistent bearing on the performance of Value vs. Growth stocks.

In the near term, interest rate movements seem to be a significant factor determining the relative performance of Value and Growth stocks:

1) Decreasing interest rates have favored Growth,

2) Relatively flat interest rates have been neutral, while

3) Increasing interest rates have favored Value.

In short, has Value vs. Growth become a duration play?

Taking a slightly longer perspective, Growth has outperformed Value persistently and significantly roughly since the Great Financial Crisis. Could an improving economy and rising interest rates indicate a rotation back towards Value? While this is possible, Cardinal does not advocate making dramatic portfolio changes on one data point. Instead, Cardinal recommends maintaining long-term allocations and avoiding dramatic moves to or away from any one style bias.

Notes:

- Price returns were used for the Russell 1000 Growth and Value indices

- Monthly dates are the last trading day of the month

- Data from Yahoo!Finance

Matt Padberg, CFA, Managing Director & Senior Consultant

Matt Padberg is a managing director and senior consultant at Cardinal.

Cardinal Investment Advisors

Cardinal Investment Advisors is a 100% employee-owned, independent firm focused solely on institutional investment consulting. After 19 years, this remains their sole line of business. Cardinal’s mission is to serve institutional investors with unique liability streams by developing, implementing and sustaining customized investment strategies that best enable their clients to fulfill their investment and operating goals in an independent and conflict-free manner.

Interested in learning more? Contact Cardinal Investment Advisors here.