OVERLAND PARK, KS – January 9, 2025 – Mariner, a leading national financial services firm,…

Rising Rates and Bond Swaps

By Mike Dziadus, Managing Director

Why are bankers bad at playing music? Because they only know how to play a Treasury note.

I was always told to start with an attention grabber—a joke, per se. Since this topic is the mundane world of investment-grade bonds, an attention grabber is necessary.

Just as interest rates started to normalize from the Great Financial Crisis, the Covid-19 pandemic hit, and the Federal Reserve sent interest rates back to historically low levels. Thus, insurers have experienced nearly 15 years of downward pressure on book yields, forcing more risk into investment portfolios to maintain investment income. As the easy monetary policy of the pandemic-era wanes, inflation has crept in and interest rates have started rising quickly. The sharp increase in rates has turned investment-grade unrealized gains into unrealized losses. Most news outlets portray the bond market outlook as full of doom and gloom, though gloomy environments often offer insurers an opportunity to thrive.

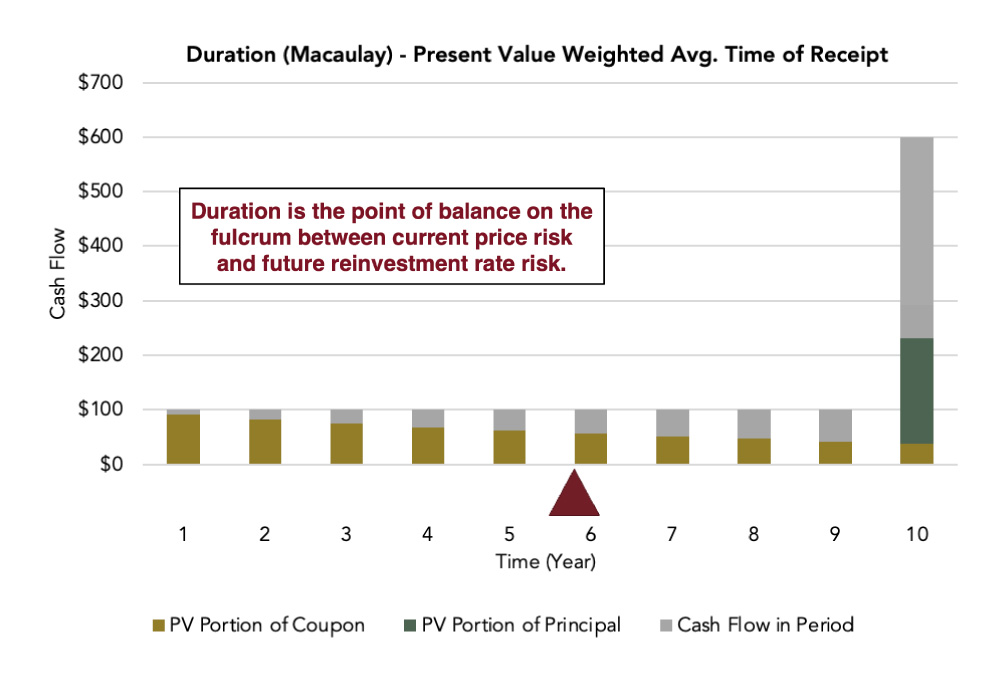

Before we get to that opportunity, let’s refresh our education on bond math. Bonds are debt instruments that pay periodic interest and then return your investment at maturity. Prices move inversely with market interest rates. If your bond is paying a coupon less than the market yield, the value of your bond drops. The price change associated with interest rate moves is simply the change in the present value of future cash flows and is measured in a metric called duration.

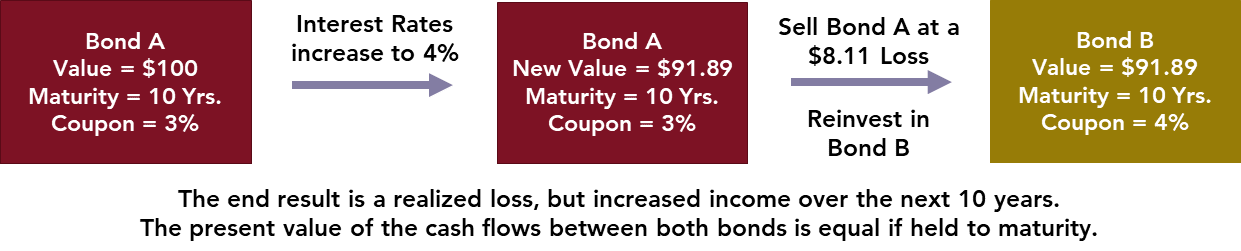

Because the price change can be determined by straightforward mathematical means, an investor can sell their bond at a loss with the knowledge of how long it will take to recover that loss via reinvestment in a new, higher-yielding bond.

Now we recall how investments are treated on a non-life insurer’s statutory statement, absent Other Than Temporarily Impaired (OTTI):

- All coupon/dividend income and realized gain/loss flow through net income and ultimately surplus.

- Investment-grade bonds are held on the balance sheet at amortized cost and price changes do not affect surplus.

- Non-investment grade bonds are held on the balance sheet at the lesser of cost or market value and price movement below cost impact surplus.

- Other investments are held on the balance sheet at fair value and the change in unrealized gain/loss flows through surplus.

On a tax basis, investment losses can be carried back five years to offset gains. There are sure to be exceptions, so each situation should be confirmed with a tax advisor.

Now that we’ve covered the education, let’s go back to the fixed income opportunity that emerges from higher interest rates. Depending on operational health and capital levels, statutory-focused insurers can realize losses in bonds today to improve book yield.

Simply put, this bond swap recognizes a loss today to earn greater income over the life of the new bond. Economically, the trade is a “break-even” if markets are perfectly efficient. However, markets are not always efficient. Active bond managers may be able to rotate sectors or find other pockets of value that tilt the reinvestment rate enough in the client’s favor that selling the bond at a loss leads to a greater total present value of cash flows over the entire combined holding period.

In addition to greater future income and added flexibility in the bond portfolio, there are a couple of ancillary benefits to this trade that may benefit some insurers.

- Carry current year losses to prior tax years. It wasn’t so long ago that corporate tax rates were 35%. If an insurer can offset 2022 losses with prior gains, they can recover some taxes paid in those years. This becomes even more beneficial if the trade can occur with tax-exempt municipal bonds where the income is taxed at 5.25%, but gains were taxed at 21% or 35% depending on the year.

- Reduce tax basis in other investments to provide more flexibility in the future. We’ve experienced strong equity markets over the past several years, and many insurers have built up large unrealized gains in equity portfolios. An insurer can realize equity gains that have built up and offset them with bond losses to both improve future income and reduce the equity tax basis for future flexibility.

The tax-loss swap will reduce net income and surplus in the current year, whereas the tax-neutral swap with risky assets will only impact the surplus. In either case, 2022’s move in interest rates should lead to conversations to determine if this flexibility can be used to create opportunities.

Cardinal Investment Advisors is a 100% employee-owned, independent firm focused solely on institutional investment consulting. After 20 years, this remains their sole line of business. Cardinal’s mission is to serve institutional investors with unique liability streams by developing, implementing, and sustaining customized investment strategies that best enable their clients to fulfill their investment and operating goals in an independent and conflict-free manner.

Interested in learning more? Contact Cardinal Investment Advisors here.