OVERLAND PARK, KS – January 9, 2025 – Mariner, a leading national financial services firm,…

Private Credit: Yield Enhancement

By Ann Wiesler, Managing Director

Private credit is sometimes interchangeably referred to as private debt, middle market loans, or direct lending. Real estate, infrastructure, and investment grade private placements are not considered in this discussion.

Key Takeaways

- Typically floating rate loans made to middle market companies, defined as having EBITDA less than $150 million

- Majority of deal flow is private equity sponsored, but may be directly originated

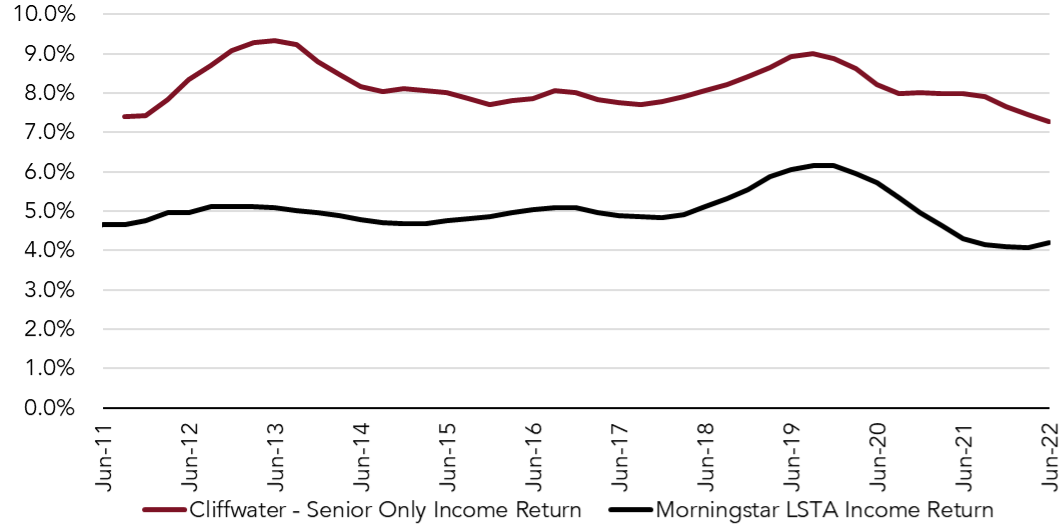

- 125 to 200 basis point yield advantage compared to broadly syndicated bank loans

- Direct lending debt is illiquid compared to public market fixed and floating rate debt

- Susceptible to impairment in stressed credit environments, but relatively high recovery rates in the event of default

- Higher investment manager and performance fees than public market strategies

- Performance benchmarking is challenging

Asset class attributes

Direct lending is an established asset class consisting of senior secured loans made to middle market corporate entities with generally less than $150 million in EBITDA. Historically this form of lending was the domain of commercial banks, but today it is increasingly executed through private capital raised by institutional asset managers.

Examples of underlying collateral include business inventory, equipment, property, plant, cash receivables, and even royalties. Unlike public market fixed and floating rate debt, direct lending is illiquid—there is no secondary market. In other words, once made, private loans cannot be sold to other investors. Due to its illiquid nature, investors expect yield compensation over the liquid loan market, also known as an illiquidity premium.

Borrowers often pay upfront fees which can further enhance returns to the investor. Loan maturities are typically three to seven years with the possibility of prepayment, which may result in additional fees to the lender. Credit protections found in private direct lending structures, known as loan covenants, typically result in better outcomes. As the broadly syndicated market has moved to more covenant-lite deals, many private credit managers still include maintenance or incurrence covenants in most structures.

The workout process could be easier in the private credit space as there are fewer lenders with fewer potential conflicting interests. As a result, middle market loans have historically experienced lower default rates and higher recovery rates compared to broadly syndicated bank loans.

Non-bank lenders fill a need for a large segment of the corporate credit market that currently has few options. Traditional bank lending decreased from 50% of the leveraged loan market in 2000 to 10% in 2022, yet small to middle market businesses represent nearly 90% of all business in the U.S. There is an opportunity for lenders to provide capital and fill the supply and demand gap as banks exited the market due to increased regulatory and capital requirements after the global financial crisis. The need for credit and lack of alternative financing options also allows direct lenders to charge higher interest rates. Direct lenders are not subject to the same capital requirements as banks and have more flexibility with financing, deal structures, and terms. There is also a greater certainty of financing with private lenders vs. public markets, particularly during heightened market volatility. With over 250,000 small and medium size businesses, the market is substantial and funding needs continue to rise.

Manager research focus

Due to the lack of publicly available data, the manager selection process is more challenging for private market assets. Significant differences in strategy, market expertise, and product availability make implementation more difficult than in the broadly syndicated loan market. Key tenants of each manager’s approach to direct lending center around differentiating factors.

- Management: team specific information, investment committee, decision makers, track record through economic cycles

- Strategy flexibility: tailored to fit client needs, multiple options that focus on first lien only, unitranche, second lien, opportunistic, and/or equity

- Sources and opportunity set: size of overall platform, number of sponsors, deal flow, origination team

- Underwriting due diligence: documentation, financial covenants, cash flow analysis

- Risk management: day to day operations, monitoring, trading, risk analytics, legal and restructuring

- Return target: target spread over SOFR or T-Bills, absolute return, levered or unlevered

- Fees: management fee, incentive fees, and administration fees

Implementation considerations

Deciding how to implement a private credit strategy requires due diligence and knowledge about strategy risk and return profiles, with special considerations around each manager’s approach toward the borrower size (upper, middle or lower market), overall credit seniority, and manager availability.

Characteristics unique to private asset classes, specifically direct lending, that require consideration prior to manager selection:

- Market exposure: large, middle, or small

- Credit exposure: senior secured to mezzanine

- Diversification: geographic, sector, and industry

- Fund availability: closed-end, evergreen, or capital efficient rated note structures

- Fundraising efforts: universe of managers changes over time

- Vintage year exposure: funds tend to have 7 to 10-year time horizons

Some managers may provide access to multiple areas of direct lending, but in other cases it may be appropriate to blend multiple managers into “core and satellite” allocations. Core managers can represent senior secured lending with a lower risk profile. Smaller allocations to levered or more concentrated “specialist” managers can act as a complement to achieve higher returns.

Conclusion: Higher yield, less liquidity, diversification, and capital efficiency

Private credit offers institutional investors the opportunity to achieve higher yields from exposure to less liquid middle market loans. Additionally, lending to middle market borrowers helps to diversify issuer exposure within institutional portfolios. Finally, there are efficient implementation options (separate accounts and rated fund structures) available for investors who are sensitive to risk-based capital constraints.

Cardinal Investment Advisors is a 100% employee-owned, independent firm focused solely on institutional investment consulting. After 20 years, this remains their sole line of business. Cardinal’s mission is to serve institutional investors with unique liability streams by developing, implementing and sustaining customized investment strategies that best enable their clients to fulfill their investment and operating goals in an independent and conflict-free manner.

Interested in learning more? Contact Cardinal Investment Advisors here.