We are thrilled to announce that Cardinal Investment Advisors has been named ‘Investment Consultant of…

Our Responsibility to ESG Stewardship

By Keith Chambers, Managing Director and Nathan Sklare, Consultant

Environmental, Social, and Governance (ESG) investing has become one of the most frequently discussed investment topics among institutional investors. Extreme weather, employment relations, and compensation practices are just a few ESG issues that put fresh scrutiny on metrics long regarded as secondary investment considerations.

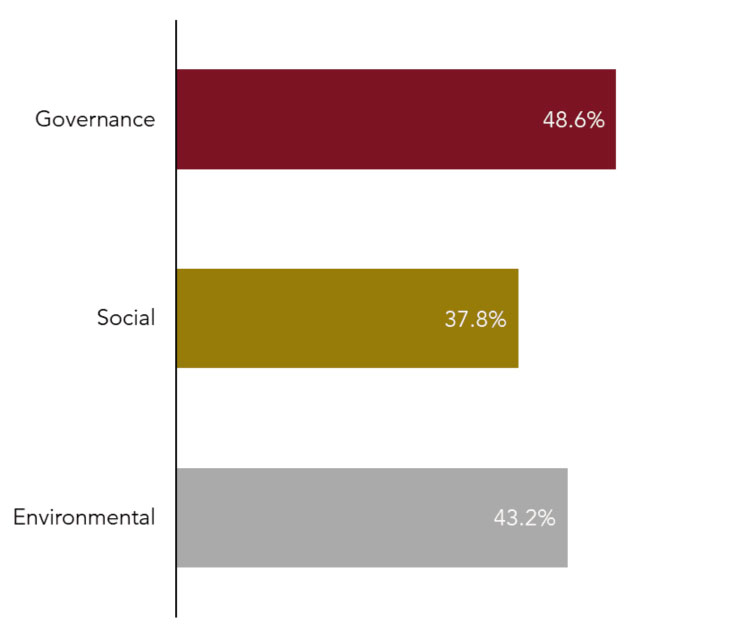

A recent poll of Cardinal’s clients shows that a large (and growing) number of companies already incorporate ESG factors into their business practices.

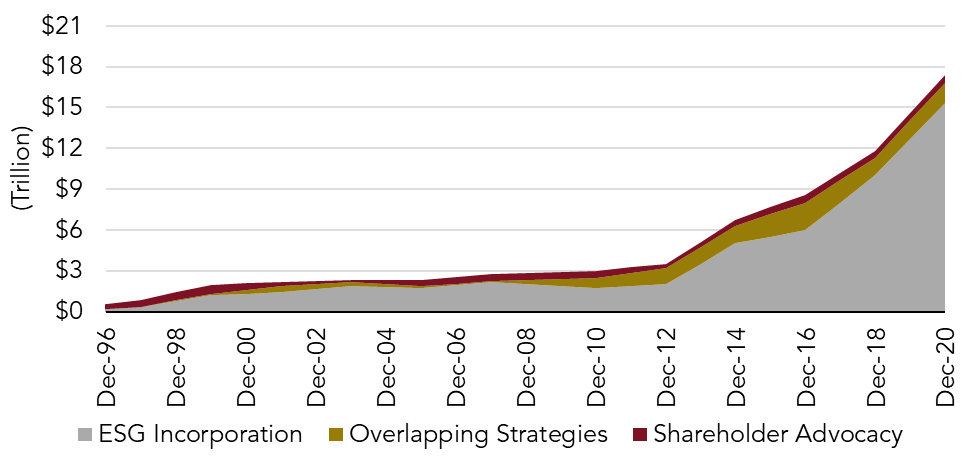

Furthermore, according to The Forum for Sustainable and Responsible Investment, at the end of 2019 roughly $17 trillion in professionally managed assets could be considered sustainable investments. This figure has grown rapidly in the past several years, and represents roughly 33% of total professionally managed assets.

Cardinal’s approach to ESG assessment

At Cardinal, we are seeing increased interest in using an ESG lens to review and position investment portfolios. Motivation ranges from preempting AM Best or other regulatory concerns, to seeking incremental returns, to internal altruism. While the motivational drivers may differ, in all cases there is a focus on the risks that can affect financial performance. Cardinal developed an ESG “toolkit” to enable client conversations on ESG risks and opportunities. Our analysis helps clients translate ESG policies into action, by better understanding how their investment managers integrate ESG factors into the investment process.

A detailed ESG portfolio review enables clients to know where they stand on a topic that is front of mind for many investment committees. Our aim is to provide clients with a bottom-up and top-down ESG evaluation across every investment strategy. To do this, we combine a quantitative ESG portfolio score with our proprietary qualitative ESG manager assessment. Taken together, these tools offer a 360-degree examination of investment portfolios, helping to evaluate the extent to which ESG risks and opportunities are actively reflected in a manager’s process.

Quantitative analysis

ESG risk should be measured on both an absolute and relative basis. The most ESG-aware energy pipeline strategy will likely score worse in absolute terms than a developed international equity strategy that completely ignores ESG inputs due to natural resources and emissions’ intensity in energy markets and additional regulatory steps, especially in European markets. In simple terms, absolute results are informative, but sector relative context matters.

Our analysis can cover the full spectrum of ESG concerns or focus on specific Environmental, Social, or Governance elements, allowing clients to understand how investment managers are addressing their unique ESG concerns.

We assess the level of risk mitigation and opportunity capture in each portfolio pertaining to a wide variety of Environmental, Social, and Governance metrics. Absolute measures can help identify tail risks in the portfolio, while benchmarking shows whether investment managers are taking outsized ESG risks or failing to capture opportunities relative to their opportunity set. By updating this portfolio scoring at specific intervals, we can understand whether investment managers are improving the risk-mitigation and opportunity to capture the capabilities of portfolios.

We recognize that ESG data analytics is a nascent but quickly evolving industry. There is no consensus regarding data collection or interpretation practices. Regardless, taking steps to incorporate ESG data into an overall portfolio analysis can help investors start the process. Assessing the impact of ESG factors on both corporate and investment performance has become a best practice.

Qualitative context

In addition to quantitative review, Cardinal conducts a qualitative assessment. In this assessment we examine the investment managers across a variety of perspectives including corporate ESG policies, ESG factor usage in investment portfolios, external investment engagement, and internal diversity and inclusion policies. This provides investment managers the opportunity to show how they reflect ESG principles and practices at a firm and strategy level.

We delve into specific topics designed to understand how investment managers factor ESG considerations into firm processes. We give significant weight to both internal and external firm Diversity, Equity, and Inclusion (DEI) practices. The goal is to provide a holistic appraisal of each manager, identifying those with best practices in place to mitigate ESG risks and capture opportunities going forward.

A new kind of credit rating

With both a quantitative and qualitative understanding of a manager’s ESG-related practices, we can see how strongly the portfolio ESG scores are informed by ESG procedures. In other words, is there purpose to the investment manager’s strong, or weak, ESG score? Would more robust ESG data integration by the manager translate into forward-looking risk mitigation?

As more research is conducted and published on ESG, one goal we should all have is to standardize risk metric scoring, like credit ratings. As best practices are better established in ESG portfolio analytics, we as consultants, and our clients as investors, can be even better attuned to true causes and effects of material ESG factors and their impact on portfolio performance.

Cardinal Investment Advisors is a 100% employee-owned, independent firm focused solely on institutional investment consulting. After 20 years, this remains their sole line of business. Cardinal’s mission is to serve institutional investors with unique liability streams by developing, implementing and sustaining customized investment strategies that best enable their clients to fulfill their investment and operating goals in an independent and conflict-free manner.

Interested in learning more? Contact Cardinal Investment Advisors here.